ORTECH Comments on Long-Term Energy Plan

ORTECH Consulting Inc. (ORTECH), renewable energy, energy storage, greenhouse gas (GHG) and air emissions consulting, auditing and testing experts, would like to thank the Ministry for the opportunity to provide our view on the Long-Term Energy Plan (LTEP) and for providing substantive supporting documentation such as the Ontario Planning Outlook (OPO) to allow us to formulate a meaningful response.

ORTECH commend the government as well as their agencies and their partners in industry in pursuing the goal of a supply of energy that is sustainable both environmentally and economically. Energy is fundamental to all forms of activity today and many take for granted its reliability and convenience of access. Energy is the fuel which drives not only our economic activities but also much of what we do in our everyday lives. A LTEP in today’s changing world must be broad and far reaching, and touch on many different areas.

The breadth of the LTEP is important for Ontario to continue driving down GHG emissions. As clearly identified in the Fuels Technical Report (FTR), the GHG emissions associated with electricity have been falling for some time and are now a very small contributor to Ontario’s total GHG emissions. Electrification of other energy uses such as heating and transportation will allow the use of decarbonized electricity to displace more GHG in these other energy use categories. This represents a new approach to energy planning as previous LTEPs have had a very dominant focus on electricity. Such an approach will require coordinated action from multiple Ministries and agencies.

ORTECH comments on the LTEP are structured to follow the Discussion Guide and are provided in the order of the subject areas presented in that document.

Distribution and Grid Modernization

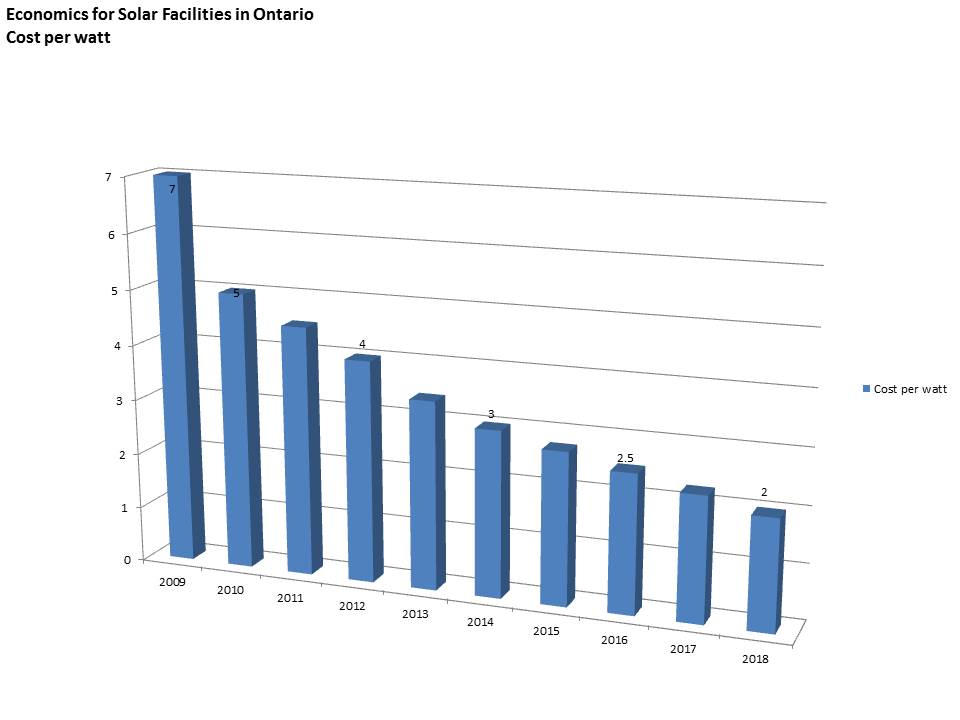

The global trend towards behind-the-meter generation will have substantial impacts on the utility sector. With the continually falling cost of photovoltaic solar and the steadily increasing retail cost of electricity, the push to self-generation is constantly increasing. ORTECH is encouraged to see that the Ministry is embracing these changes with proposed updates to the net metering regulation such as Single Entity Virtual Net Metering, removal of the 500 kW cap, and explicitly acknowledging the role of energy storage in net metering type applications.

One concern with distributed generation is the phenomenon referred to as the “Utility Death Spiral”. As rooftop solar reaches grid parity customers begin to switch towards self-generation. This reduces the amount of energy delivered by the local distribution company (LDC) which is at least partially compensated on a per kWh delivered basis. Rates are often increased to make up for lost revenue, however higher rates only serve to further incentivize self-generation, resulting in a feedback loop or Utility Death Spiral.

One possible way to avoid the Utility Death Spiral is by having the LDCs play a larger role in distributed generation. LDC’s understand their customers and dealing with distributed electrical infrastructure is their core business. They are ideally positioned to facilitate further uptake of distributed generation, increase the penetration rates of clean energy, and alleviate the need to bring power from distant centralized generators to the load centres where it is needed. Powerstream’s award winning Power House pilot program is an example of this and shows how utility-customer partnerships may work in the future.

Microgrids

Microgrid solutions are not only for remote communities. Microgrids can operate in parallel with the grid, providing the advantages of resiliency and robust infrastructure. Combining microgrids with district energy or community energy resources can create strong nodes where energy can be supplied even in extreme circumstances. Many applications demand very high reliability of energy supply resulting in mission critical equipment with high costs for low utilization. A microgrid approach to these applications can enable those systems to provide other benefits allowing for better use of existing equipment.

Microgrids can also be used to provide alternate benefits such as improved power quality, load shifting and peak shaving, amongst others. Using microgrids in this way can provide more reliability than traditional fossil fired back-up generators as microgrid systems will essentially be continuously tested.

Energy Storage

Achieving Balance stated that the government was to include energy storage technologies in its procurement process starting with 50 MW and assessing engagement on an ongoing basis. This was to include: “commissioning an independent study to establish the value of energy storage’s many applications throughout the system; examining the opportunities for net metering and conservation policies to support energy storage; and providing opportunities for storage to be included in large renewable procurements.”

At the end of 2016, it appears that energy storage procurement started and ended with 50 MW. The Large Renewable Procurement (LRP) was to have “mechanisms to encourage innovative technologies and approaches, including considering proposals that integrate energy storage with renewable energy generation for upcoming procurement cycles”. While an on-peak/off-peak pricing mechanism was included in LRP 1, it did little to encourage energy storage integration. The benefit and capability of energy storage to smooth variable generation as well as provide additional reliability was not valued by the LRP 1 RFP. The sole mechanism for incorporating energy storage was for power shifting. However, this one application discounted the benefits provided by energy storage. As an explanation, the LRP 1 RFP determined the “effective capacity value” of various generation technologies which represented “the amount of capacity that can be counted on at the time of system peak”. Adding energy storage to a variable generator for the purposes of power shifting would significantly increase this value, but the RFP scoring rubric did not allocate any benefit for this.

ORTECH would like to commend the Ministry on moving forward with the first 50 MW of procurement. This program put Ontario at the forefront of the emerging industry of grid scale energy storage and marked the province as a global leader in the space. However, a lack of additional support for energy storage will pose the risk of being surpassed by other jurisdictions.

Innovation and Economic Growth

Start-stop procurements can be quite disruptive to industry. Gearing up for major RFPs followed by long periods of no activity hinders private sector planning and exacerbates the boom-bust cycle. The Feed in Tariff (FIT) program is a good example of how programs can operate more smoothly with similar sized procurements that are repeated over short time frames. However, even with FIT procurement, program windows are announced one at a time resulting in considerable uncertainty as to future market opportunities. Smaller procurements that are repeated more frequently will smooth out the roller-coaster type activity level in the Ontario industry, and greater certainty in future procurements and activity will help the industry develop the right level of capabilities to address needs.

Climate change is a global concern. Clear and effective long term programs will allow Ontario industry to refine the expertise to address these challenges providing a basis to assist other jurisdictions reduce their environmental footprint, and to benefit from these export opportunities. However, a healthy domestic market that supports renewable energy and energy storage industries is required.

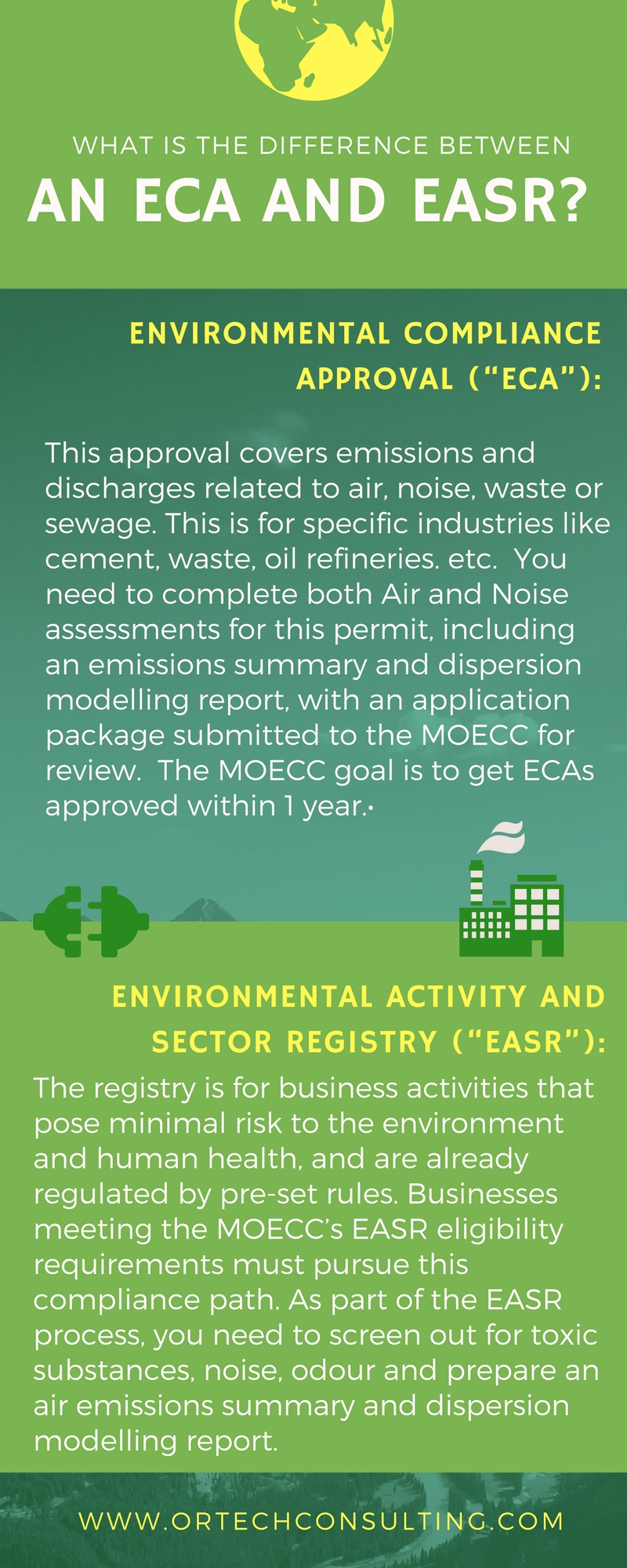

It is generally acknowledged that environmental permitting is slowing down the development of projects. This year’s Burden Reduction Act introduces the possibility of streamlining the permitting process. However, it’s not yet clear if this will have appreciable benefit for energy projects.

Clean Energy Supply

The OPO identified potential scenarios where electrical demand is increased. These are related to electrification and a shift away from fossil fuel usage in transportation and heating. It is important that additional electricity generated to meet these needs is clean energy otherwise no GHG benefit would realized from electrification. For example, if higher electrical demand is mostly met by natural gas fired generators, the benefit of displacing natural gas fired heating with electrical heating is diminished.

Since the Green Energy and Economy Act of 2009 came into effect, Ontario has aggressively pursued renewable energy development resulting in substantial amounts of renewable generation capacity being installed. This domestic demand for wind, solar and other forms of renewable generation allowed a strong industry to develop in the province. With advances in generating technologies and a strong local industry that is ready to deliver projects, Ontario is in a position to build wind and solar projects at competitive rates.

The LRP 1 (in 2015) procured wind energy for a capacity weighted average of $86 per MWh and solar for $157 per MWh. These rates are competitive with other generation technologies, with wind being one of the lowest cost forms of generation in the province and solar rapidly closing the gap. This is supported by the OPO Data Tables which list current technology characteristics and show the range of levelized unit costs of electricity for wind and solar to be cost competitive with all other forms of generation. It should also consider that wind and solar are still experiencing significant cost declines as the technology matures and the industry increases in scale. While Conservation First remains the strongest economic performer in the province, Ontario’s supply of clean energy will be most efficiently procured from wind and solar.

Summary

ORTECH recognizes the importance of the LTEP to the Province of Ontario and thanks the Ministry for the opportunity to provide comments. ORTECH comments are summarized in pint form below:

- Have the LDCs play a larger role in distributed generation

- Combine microgrids with district energy or community energy resources

- Assess the full value and expand the support for energy storage to ensure Ontario remains at the forefront of this evolving technology

- Expand clear and consistent procurement programs (e.g. FIT) to ensure market certainty which will lead to the development of the right level of capabilities to address needs

- Further streamline the environmental permitting process

- Wind and solar are becoming increasingly more cost competitive and thus represent an opportunity for expanded development while addressing further reductions GHG emissions from the overall energy supply system

A strong domestic clean energy industry will allow for GHG reductions beyond our borders through clean energy trade. Ontario is already a net exporter of electricity and the jurisdictions where our clean electricity is being sold include regions that still rely heavily on coal-fired power plants. While the GHG emissions associated with the electricity used in province is already very low, additional low carbon electricity still has the potential to reduce GHG emissions on a global scale.